Buyer’s market. Buyer’s market. Buyer’s market. Seems to be the real estate mantra these days. So buy already, why don’t you. But maybe if you hold off for another month or two, housing prices will drop some more and you’ll get a better deal. Or will you?

“I certainly wouldn’t recommend that someone sign a lease for another year,” says Greg Slater, an associate broker with Real Estate III and the director of sales and marketing for Church Hill Homes. “But you don’t have to rush into anything either. Today’s market isn’t like it was when you had to pounce on a place fast, before someone else got it.”

We get it: plenty of inventory means that the bad old days of bidding wars, writing an offer without a home inspection and composing love letters to convince sellers that you’re a worthy purchaser are history. Does the same go for falling prices?

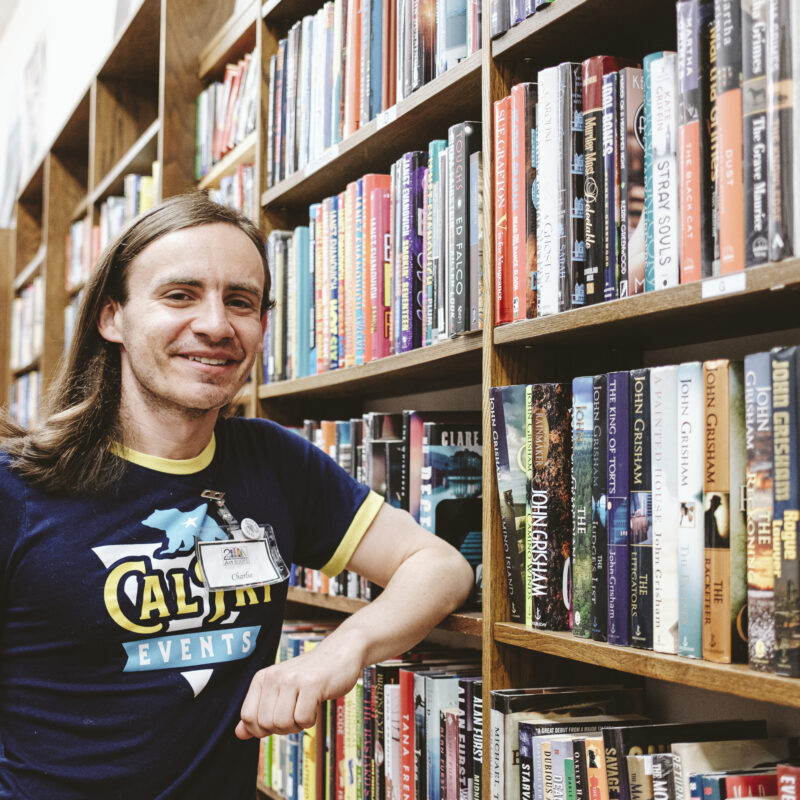

Broker Greg Slater declares now the time to buy. "You should be shopping, shopping, shopping," he says. Broker Greg Slater declares now the time to buy. "You should be shopping, shopping, shopping," he says. |

“Some of the national information out there shows that we hit bottom last year, and I tend to agree with that,” says Slater. “I think the market’s bottomed out and leveled off.”

Bottom or no, there was definitely an adjustment, which means “buyers have a lot more negotiating power than sellers,” Slater says. “I do think that now’s the time to buy. You should be shopping, shopping, shopping. See what’s available in your price range. Find a place you love, and then negotiate. If you think the house is overpriced, you don’t have to pay that price.”

In other words, it’s the buyer, not the seller, who sets home prices nowadays.

“There are a lot of really great deals out there,” he says. “Builders with finished inventory; houses on the market for more than four months—both indicate that there’s room for negotiation.”

And as long as you’re the one calling the shots, why not throw out a lowball offer, especially if a house has been sitting around for a while? Maybe the owners have grown desperate, and now must sell because of a job transfer, a divorce or financial woes. It could turn out that your bid isn’t so outrageous after all, especially if it’s the only one the homeowners have received.

Another upside to a down market is that the all-important comparable values—a list of recent sales—become less crucial. You certainly should take a look at public real estate records (realestate.charlottesville.org or albemarlevapropertymax.governmaxa.com/ propertymax) and real estate info websites such as trulia.com and zillow.com. But don’t feel that what you see there carries the same weight it did a couple years ago, when homes were being snapped up before Open House signs could be jammed in the ground. Look at these numbers as more useful to sellers, a guide to what they should ask, but perhaps not an indicator of what they’ll take.

Keep in mind, though, that even if you snag the real estate deal of a lifetime, it has to be for the right dwelling—in a neighborhood you like with good schools. Oh, and you should plan on living there for a while because, according to Slater, the odds are slim that after six months you’ll be able to flip it and score a 20 percent profit. That kind of market truly is history.

“But houses are still an excellent investment,” Slater says, adding that “all the things that make our real estate market good, and Charlottesville a great to place to live, are still here.”