The local real estate market remained relatively flat in April, May, and June, while prices continued to increase. That is reflected in the latest quarterly report from the Charlottesville Area Association of Realtors.

There were 1,087 sales in the six localities covered by CAAR in the second quarter of 2025 compared to 1,100 sales the previous year.

“The interest rates are basically the same, the number of sales units is essentially unchanged but the prices continue to climb,” says CAAR President Josh White. “The median price for the region is at $485,000 which is a 5 percent gain.”

That continues a steady trend upwards from a median price of $376,000 in the second quarter of 2021.

The sales volume trend is not universal, with home sales up slightly in Charlottesville and Greene and Nelson counties. In Charlottesville, there were 149 homes sold in the second quarter of this year compared to 134 in 2024. Sales volume dropped 2 percent in Nelson, 4 percent in Albemarle, and 12 percent in Louisa.

Sales prices were up in five of the six localities, with Albemarle County the most expensive with a median sales price of $575,000, up 8 percent from $533,750 in 2024. Fluvanna County is the most affordable, with a median sales price of $385,000.

Charlottesville bucked the trend with an average sales price decrease of 2 percent to $509,000, down from $520,000 in 2024. White says that might be because there were more homes on the market than last year.

“More competition could certainly influence the prices dropping as sellers may be more incentivized to offer their home at a lower price or offer concessions to get the deal to the closing table,” White says.

There was also an 8 percent decrease in the median sales price for new construction from $514,057 last year to $471,610 in the second quarter of 2025.

Rates for a 30-year mortgage are about the same as last year at 6.77 percent. Four years ago rates hovered above 2 percent and have gradually increased as the Federal Reserve took steps to fight inflation.

“If interest rates would drop, that could further increase pricing as more purchasers come to the market who may be priced out by current rates,” White says, adding that sales prices will likely continue to increase until more homes are on the market.

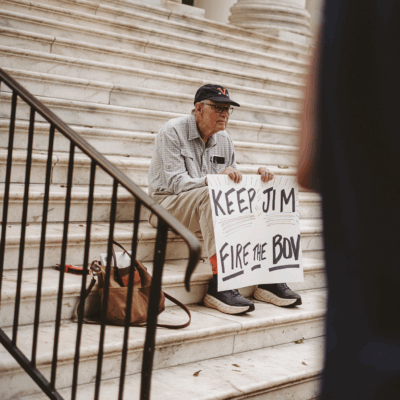

Local realtor Jim Duncan of Nest Realty says he doesn’t think interest rates are playing that big of a factor.

“I see the market is slowing due to intentional national uncertainty with respect to employment, tariffs, and the cuts that are affecting UVA and other educational institutions,” Duncan says. “Homes are absolutely still selling, and buyers do want to purchase.”

Houses and condominiums are also spending more time on the market. In the first quarter of 2021, the average was five days and that has increased to nine days in the second quarter of 2025.

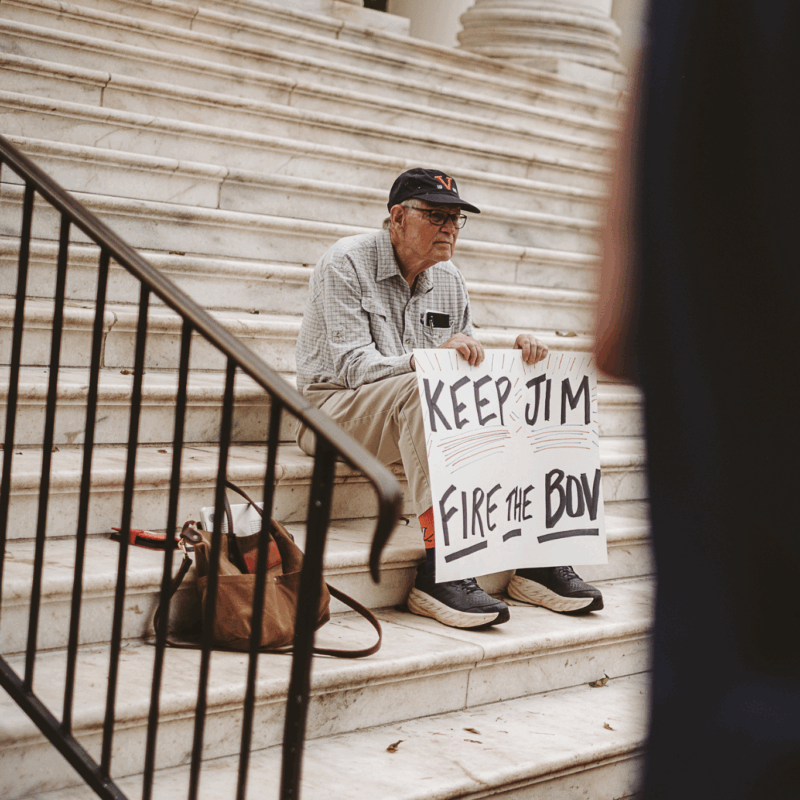

Home sales were up slightly in Charlottesville and Greene and Nelson counties in April, May, and June. File photo.